Arm Stock: Bullish Forecast? Yeah, Right.

Generated Title: Arm's AI Forecast: Or Just More Silicon Valley Hype?

Okay, Arm's giving us the ol' "AI boom" song and dance again. Fiscal third-quarter revenue projected at $1.23 billion, profit at 41 cents a share...blah, blah, blah. Analysts are creaming their jeans over 35 cents a share on $1.1 billion. Give me a break.

The "AI Revolution" - Or Just a Marketing Ploy?

Seriously, are we STILL buying into this "AI revolution" nonsense? Every company, from your local dog groomer to freakin' Arm, is slapping "AI" on everything to juice their stock price. It's the new "blockchain," except even less tangible.

And, offcourse, they're banking on the idea that we're all too stupid to realize it. I mean, what does "designing chips to run AI data centers" even mean? Sounds like marketing gobbledygook to me.

Here's what probably happens: They tweak an existing chip design, add a few lines of code, and suddenly it's an "AI-optimized" marvel that will change the world. Right.

The Illusion of Innovation

It's all smoke and mirrors, people. The tech industry has always been about creating the illusion of innovation, not actual, you know, innovation. Remember the dot-com bubble? The metaverse? Web3? All hyped-up garbage that promised to change the world and delivered... well, nothing.

What makes this time different? Nothing, that's what.

And the analysts? They're complicit in this charade, cheerleading every overhyped trend to keep the gravy train rolling. They pat themselves on the back for "accurately predicting" Arm's revenue, but what they're really predicting is the effectiveness of Arm's marketing department.

I mean, is anyone stopping to ask if this AI stuff is even useful? Or are we just blindly throwing money at anything with the letters "A" and "I" in it?

The Bottom Line (Or Lack Thereof)

Look, I'm not saying Arm is a bad company. They make decent chips, I guess. But this whole "AI demand surge" narrative smells fishy. It's the same old Silicon Valley hype machine churning out the same old promises of a brighter, more automated future. A future that never quite arrives. According to a Arm Gives Bullish Forecast, Pointing Toward AI Demand Surge, the company itself is anticipating this surge.

Maybe I'm just being cynical. Maybe this time is different. Maybe AI really will revolutionize everything. But let's be real, folks: I ain't holding my breath.

So, What's the Real Endgame Here?

Arm's just playing the game. They're selling a dream, and we're all willingly buying it. The problem isn't Arm; it's us. We're so desperate for the next big thing that we'll believe anything. And until we wake up and demand real innovation instead of empty promises, this cycle will just keep repeating itself.

Related Articles

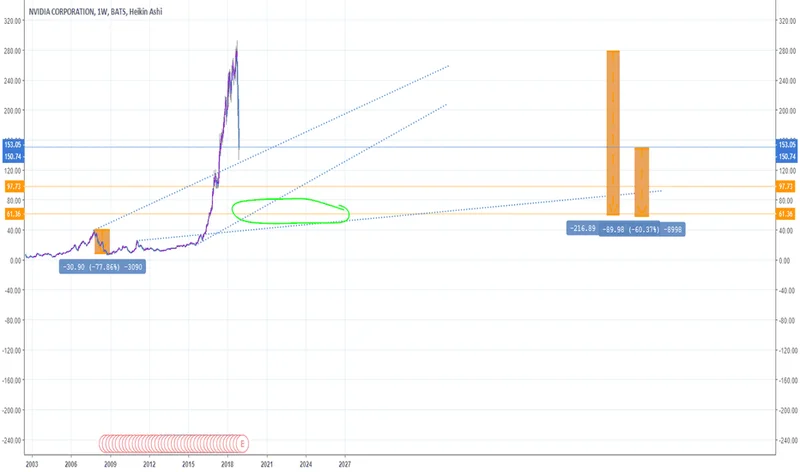

NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, ha...

TTD Earnings: A Marginal Beat vs. Cautious Guidance

The Trade Desk's Wild Ride: Are We There Yet? The Trade Desk (TTD) just released its Q3 earnings, an...

GOOGL Stock: Unlocking Its Visionary Potential Among Tech Titans

Look around you. Everywhere you turn, there’s a hum of anticipation, a palpable energy in the air. W...

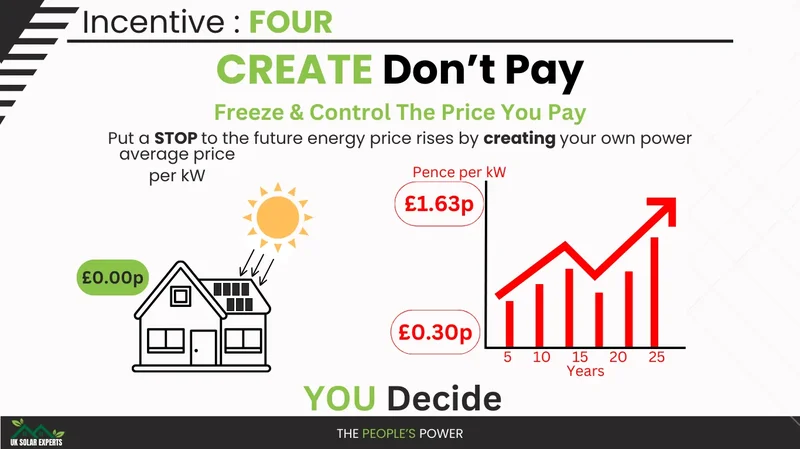

Federal Solar Incentives Are Ending: A Data-Driven Breakdown of the Financial Impact

Oregon Governor Tina Kotek is in a race against the clock. With an executive order, she has directed...

Southwest Airlines Overhauls Its Seating Policy: What This Means for Travelers and the Future of Flying

For decades, flying Southwest Airlines felt like stepping into a time capsule. The open seating, the...

IonQ Stock Price: What's Driving the Volatility and Investor Reactions

So, IonQ's building a quantum network in Geneva. Big deal. Another press release filled with buzzwor...