Bitcoin vs Ethereum: The Choice is a Lie. (Reddit Thread Explodes)

Ethereum Investing's "Educational Guide": Or, How to Sell You the Shovel During a Gold Rush

So, another "comprehensive educational guide" to Ethereum investing drops, huh? Give me a break. It's like clockwork. Every time crypto gets a little buzz, out come the self-proclaimed experts, ready to "educate" you right into their affiliate links.

Let's be real, folks. This guide, courtesy of the Weiss Crypto Investor crew, ain't about education. It's about marketing. They want you hooked on their "systematic frameworks" and "data-driven metrics." Oh, and don't forget their "proprietary rating system." Sounds legit, right?

They're patting themselves on the back for not taking money from the crypto projects they rate. That's the bare minimum, people! It's like a restaurant bragging they don't serve rat poison.

Staking: 3-6% Returns? Don't Make Me Laugh

The Staking Game: 3-6% Returns? Seriously? They’re dangling those sweet, sweet staking yields – 3-6% annually. As if that's some guaranteed return carved in stone. Newsflash: it fluctuates. A lot. It's crypto, not a savings bond. And the more people staking, the lower those rewards go. Basic economics, people. And all this talk about smart contracts and decentralized finance... It sounds revolutionary, right? But how many people *really* understand the underlying tech? How many can actually read the code? And how many rug pulls and exploits have we seen in DeFi? Too many to count. They're saying Ethereum is the platform for "real-world asset (RWA) tokenization." Tokenization. It sounds so futuristic and important. But what does it *actually* mean for the average person? Probably not much. Ethereum Investment Strategies Explained: Smart Contracts, Staking Yields, and Institutional Adoption Trends - Newswire :) Press Release DistributionInstitutional "Help": Thanks, I Hate It

Institutions Are In! So Should You Be? Oh, and the institutions are getting in on the action: BlackRock, Franklin Templeton, JPMorgan. That's supposed to make us feel better? That the same giants who crashed the economy in '08 are now playing around with blockchain? I don't know about you, but that doesn't exactly inspire confidence. They highlight the Ethereum ETFs now trading on major exchanges. Regulated exposure, they call it. As if regulation magically erases all risk. Remember when Enron was "regulated"? Yeah, that worked out great. Plus, this whole thing feels like a victory lap for Ethereum's move to proof-of-stake. They're bragging about the 99.95% reduction in energy consumption. Good for them, I guess. But does that make the tech any less complicated or the investment any less risky? Nope. Weiss Ratings claims less than 1% of cryptos get a "Buy" or "Hold" rating from them. So, they're super selective... or super stingy with the good grades to make themselves seem more credible? I'm just asking questions here. They even give you contact info for Weiss Ratings: email and phone numbers. How convenient. It's almost like they *want* you to reach out and get "educated" even further. Can We All Just Admit... This whole thing feels like a carefully crafted sales pitch disguised as an educational resource. They're preying on people's FOMO and their desire to get rich quick. And honestly, it's insulting. But wait, are we really supposed to believe that Juan Villaverde's econometric modeling expertise is some kind of magic bullet for crypto analysis? Econometric modeling? In the crypto world? Give me a break. It's like using a weather vane to predict the stock market. Offcourse, Bitcoin laid the groundwork and Ethereum came along with its fancy smart contracts... but is any of this *really* sustainable? Or are we just riding another hype wave that's gonna crash and burn? So, What's the Real Story? It's simple: Do your own damn research. Don't rely on some "comprehensive guide" written by people who have a vested interest in you buying what they're selling. Crypto is risky. Ethereum is complicated. And anyone who tells you otherwise is probably trying to sell you something. Then again, maybe I'm the crazy one here.

Related Articles

Cross-Border Activity: What We Know – What Reddit is Saying

Alright, let's talk about cross-border investment platforms. The pitch is simple: one account, multi...

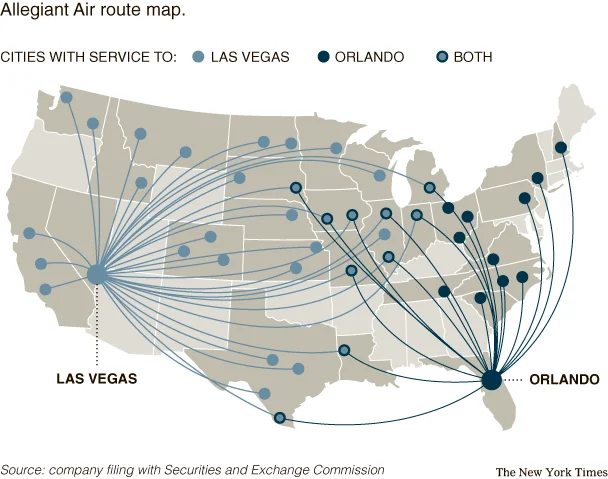

Allegiant Airlines Passenger Growth: What the 12.6% Surge Actually Means

More Passengers, Less Full Planes: Deconstructing Allegiant's Growth Paradox At first glance, news t...

Elon Musk's Pay Package Approved: What's Next?

Elon Musk's $1 Trillion Payday: Are We Living in a Simulation? A trillion-dollar payday for Elon Mus...

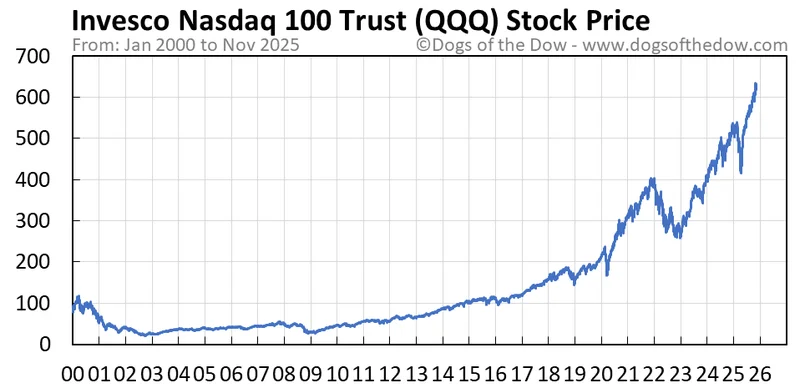

QQQ's Cash Flow Crisis: What's Happening?

QQQ's Afternoon Hiccup: Is Allsopp Right About the Overvaluation? The Invesco QQQ Trust ETF (QQQ), a...

IRS Relief Payment 2025: The 'Direct Deposit' Reality Check

Uncle Sam's Shell Game: Don't Hold Your Breath for That November Windfall Alright, folks, let’s be r...

Jack's Donuts and the End of an Era: Why It Happened and What It Means for All of Us

Of course. Here is the feature article written from the persona of Dr. Aris Thorne. * You might have...