Bitcoin Price Trapped in Indecision Zone: Why it's a fancy word for 'get ready for a fall'

Alright, let's get one thing straight: if I hear the phrase "indecision zone" one more time, I might just throw my laptop out the window. Seriously, is that the best these crypto "analysts" can come up with? It's stuck. Flat. Doing jack shit. Call a spade a spade, people.

Bitcoin: More Like Bit-Boring, Am I Right?

Bitcoin's Beige-ness So, Bitcoin's been trading sideways for, like, ever. Up 1% in the last 24 hours, down 21% over the past month? That's not volatility, that's a coma. They're saying it's trapped in a 6% range, buyers and sellers "canceling each other out." Sounds more like everyone's just lost interest. And then they hit you with the charts. Triangles, trend lines, support levels... Give me a break. The price is bouncing between $85,664 and $91,637. Whoop-dee-doo. This is the financial equivalent of watching paint dry. They're trying to make it sound exciting, though. The Chaikin Money Flow (CMF) is "climbing," which is apparently a good thing. Could be ETF inflows, could be whales buying... or, you know, could be nothing at all. It's crypto, after all. Anything is possible, including complete and utter irrationality. But here's the kicker: even the "long-term holders" are selling. You know, the guys who are supposed to be in it for the long haul? The true believers? Nope, they're bailing. The Long-Term Holder Net Position Change is deep in the red. Since November 4th, it's gone up over 300%. That's not a good sign, folks. Not at all. Short-term holders are buying, sure. But that just means there are more suckers holding the bag, waiting for the next rug pull. The article says the Bitcoin price needs to cross above $100,300 to activate a rebound setup. Otherwise, the downside can widen fast. Well, duh. If it goes up, it goes up. If it goes down, it goes down. Thanks for the groundbreaking analysis. See more in this article: One Bitcoin Price Level That Decides Everything.Ethereum's "Pressure Zone": Panic Time?

Ethereum's Existential Crisis And it ain't just Bitcoin. Ethereum's in the same boat, apparently. Trading around $3,000, but the "chart and on-chain data" indicate a "pressure zone." Oh, no, not a pressure zone! What ever will we do? They're saying momentum is weak, and long-term sellers are stepping in. Sound familiar? It should. It's the same song and dance, different crypto. The RSI (Relative Strength Index, for those of you who don't speak chart-ese) is showing a "hidden bearish divergence." Which, as far as I can tell, means the price is going to go down. Or maybe it won't. Who the hell knows? Long-term ETH holders are also dumping their bags. Nearly a million ETH offloaded between November 22nd and 28th. That's a lot of coins hitting the market. They're talking about pennant structures and Fibonacci levels. $3,016 is the key support zone, apparently. If it breaks, watch out below. $2,864, $2,619... it's all just numbers on a screen, folks. Meaningless until they actually *mean* something. This whole thing reminds me of that time I tried to build a birdhouse. I followed the instructions perfectly, bought all the right materials, and ended up with a pile of wood that looked like it had been attacked by a rabid beaver. Point is, sometimes things just don't work out, no matter how much you plan. And that's how I feel about crypto right now. All this analysis, all these charts, all this "expert" opinion... it's all just a fancy way of saying "we have no idea what's going to happen."IRYS: More Tea Leaves, Less Actual Data

The Curious Case of IRYS And then there's IRYS, this new Layer 1 data chain. Launched just a few hours ago, and already the price is "showing a wide, early trading range." Surprise, surprise. They're using VWAP (volume-weighted average price) to track where the "real" bulk of trading is happening. And OBV (On-Balance Volume) to see who's actually controlling that volume. It's all very technical and impressive sounding, but let's be real: it's a brand new coin. It's going to be volatile. Anyone who expects anything different is deluding themselves. The article mentions a possible airdrop distribution, which could explain the initial negative OBV print. Translation: people who got free coins are selling them. Shocker. They've got key levels mapped out: $0.032, $0.039, $0.042 on the upside. $0.024, $0.018, $0.014 on the downside. Basically, it could go up, it could go down. Riveting stuff. So, What's the Real Story? This whole crypto market feels like a bunch of people standing around, staring at tea leaves, and pretending they know what's going to happen next. "Indecision zone," my ass. It's a waiting game, and frankly, I'm losing interest fast. Maybe I'll go back to building birdhouses. At least then I'll have something tangible to show for my efforts, even if it does look like a beaver chewed on it.Related Articles

The ASML Stock Frenzy: Why Everyone's Suddenly Obsessed and What They're Not Telling You

Let's get one thing straight. Every time I see a headline about ASML’s stock climbing another few pe...

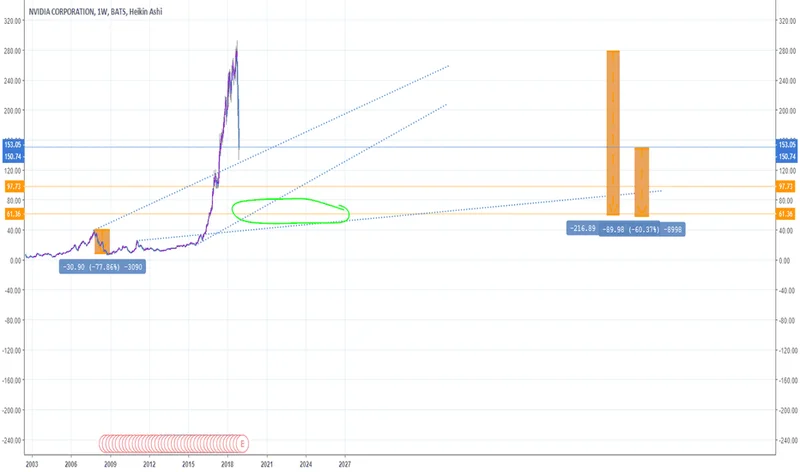

NVDA Stock Is Sinking: Why the Smart Money Is Running and What They're Not Telling You

So, the oracle has spoken. Stanley Druckenmiller, the investing world’s equivalent of a rock god, ha...

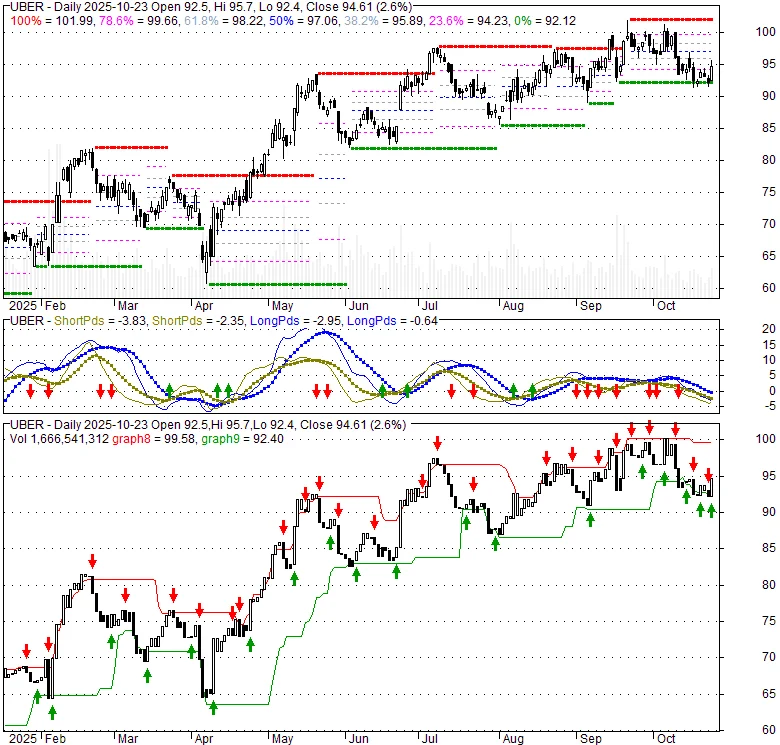

Uber's Stock Jump: The Nvidia Hype vs. the Lyft Reality

So, Uber's Tying the Knot With Nvidia. Don't Pop the Champagne Just Yet. Let’s get one thing straigh...

Scott Bessent's 'Soybean Farmer' Routine: A Masterclass in Cringey, Insulting Pandering

Give me a break. I just read that Treasury Secretary Scott Bessent, a man whose net worth Forbes clo...

The Fed's Latest Rate Cut: What It *Really* Means for the Future of Innovation

The Federal Reserve is flying blind. That’s not my assessment. That’s the word on the street from ec...

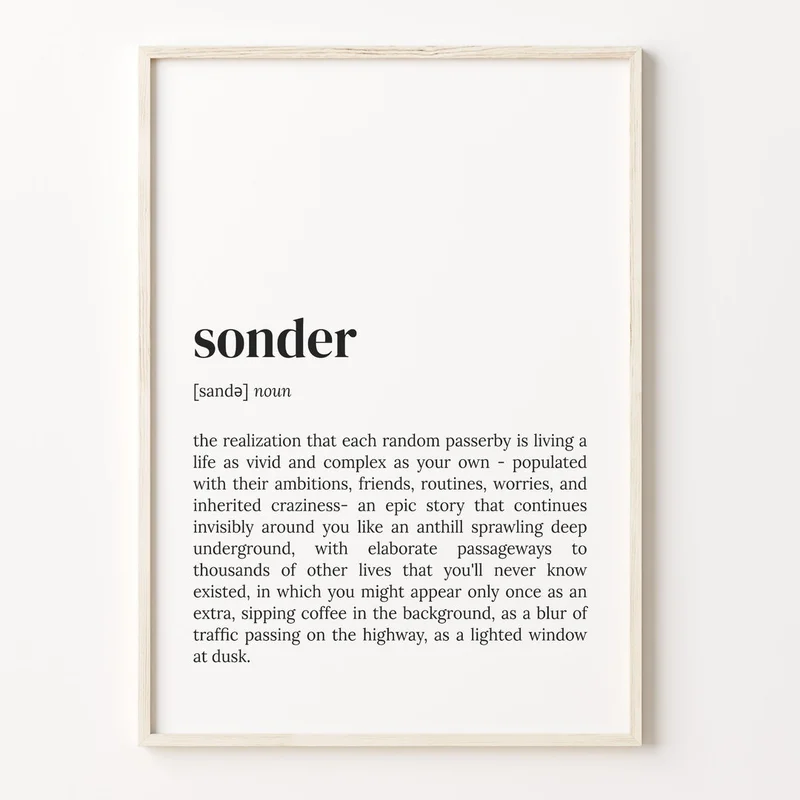

Sonder and Marriott Split: What Happened?

Marriott's Sonder Divorce: A Calculated Risk or a Costly Miscalculation? Marriott International's de...