Passive Crypto Staking: It's Not Free Money. (- Reddit Riches?)

Alright, let's get one thing straight before we dive into this crypto staking nonsense: anything promising "passive income" in the digital world should already set off alarm bells. It's usually a thinly veiled attempt to separate you from your hard-earned cash. But, since I get paid to look into this stuff, let's see what the hype is all about with crypto staking in 2025.

The Allure of "Free" Money

So, the pitch is simple: you lock up your crypto – which, let’s be real, is probably gathering digital dust anyway – and in return, you get more crypto. Sounds like magic, right? Like some kind of crypto-printing press in your digital wallet. Except, surprise, surprise, it’s not magic. It's more like a really, really convoluted high-risk savings account.

They call it "supporting the network," but what it really means is you're making someone else richer while hoping the value of your staked coins doesn't tank. I mean, imagine "you’re holding five ether (ETH) and decide to stake it through a major centralized crypto exchange like Coinbase. The average staking reward for ethereum in 2025 hovers around 4% annually, which means investors would earn approximately 0.2 ETH (about $700 at current prices) over 12 months." $700? Before taxes? After inflation? After the inevitable "oops, we got hacked" event? Give me a break.

And don't even get me STARTED on the "high APY" platforms. Bitcoin Hyper offering 41%? Maxi Doge at 73%? PEPENODE promising a ludicrous 590%? If it sounds too good to be true, offcourse, it is. These aren't investments; they're lottery tickets with extra steps. For a look at some of the platforms offering the highest returns, check out this list of 10 Highest APY Crypto Staking Platforms.

The Staking "Zoo": A Taxonomy of BS

The different "types" of staking are just layers of obfuscation designed to confuse you. Passive staking, delegated staking, active staking, direct staking, liquid staking… It's like a goddamn zoo of financial instruments designed to prey on the naive.

Liquid Staking: DeFi Inception

"Liquid staking," where you get a derivative token in return for your staked assets? That's just DeFi inception. A token representing a token that represents another token. It's turtles all the way down, and each turtle is charging you fees.

The Lock-Up Trap

And the lock-up periods? Oh, those are fantastic. You can't touch your money for weeks, months, sometimes even longer. Because nothing says "safe investment" like handing over control of your assets and hoping for the best. What if you need the money? Tough luck. What if the market crashes? Sucks to be you.

I was reading this article and it said, "During lock-up periods, you can’t withdraw your staked assets. This requirement can strongly influence both your staking plan and the rewards you earn." No shit, Sherlock.

The Real Motivation Behind Crypto Staking

* Keeping the Ponzi going: Staking locks up supply, preventing massive sell-offs that would tank the price of these shitcoins. * Enriching the insiders: The platforms and validators are the ones making real money here, skimming off the top of every transaction and reward. * Creating exit liquidity: By dangling the carrot of "passive income," they lure in new suckers to buy the staked coins from the early adopters.

But wait, are we really supposed to believe that people will continue to buy into these crypto projects?

And the worst part? People fall for it. Every. Single. Time.

Crypto Staking: Gambling With Extra Steps

Look, if you want to gamble, go to Vegas. At least the drinks are free, and you might get a comped room out of it. This crypto staking crap? It's just gambling with extra steps, extra fees, and a whole lot of jargon designed to make you feel like you're "investing."

Then again, maybe I'm the crazy one here. Maybe I'm just too cynical to see the bright future of decentralized finance. Nah, who am I kidding?

The Unlikely Scenario: Maybe You'll Get Lucky?

So, what's the real story? If you wanna roll the dice, go ahead. But don't come crying to me when your "passive income" turns into a passive loss.

Related Articles

The October TV Dump: A Guide to What Isn't Total Garbage

So, how soon is too soon? Apparently, the answer is "never." It's been a year since the Hamas attack...

eth price: analysis and trader losses

Ethereum's $3,700 Cliff: Is This Just a Dip, or the Start of a Real Slide? ETH's Rocky Road: Data Di...

PAX Gold: What It Is and Why You Should Be Skeptical

So, everyone’s losing their minds because gold, the world’s oldest pet rock for paranoid investors,...

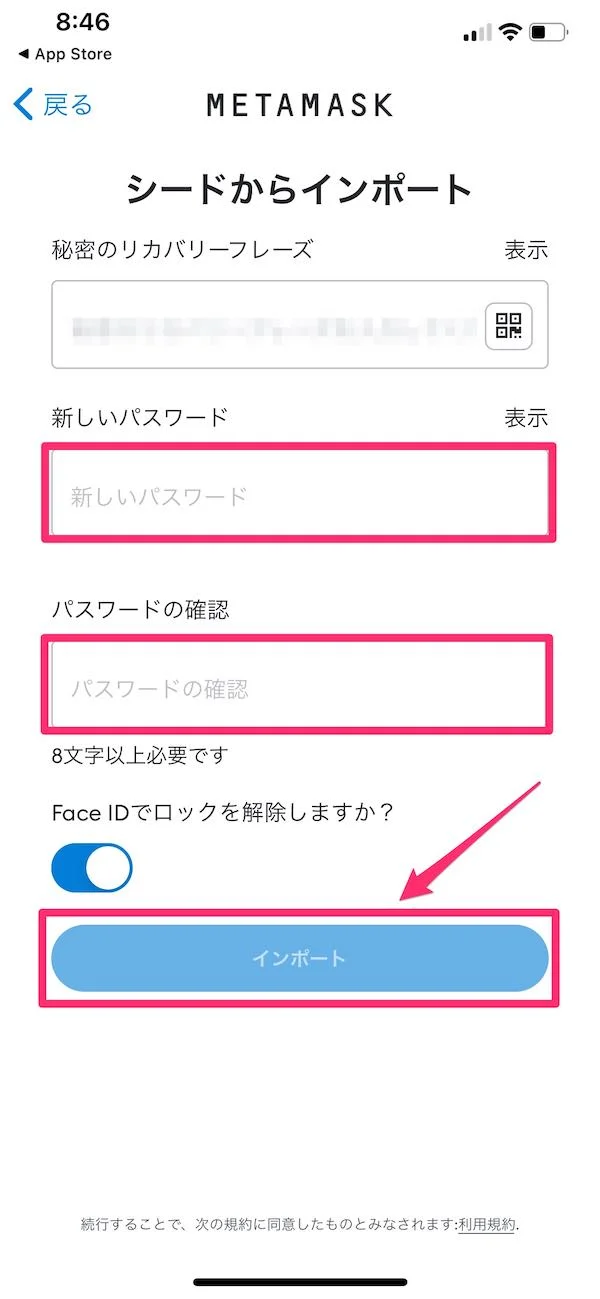

MetaMask: What It Is, How It Works, and Why It's Your Key to Web3

For years, we’ve thought of MetaMask as a key. A simple, indispensable tool. It’s the friendly fox i...

Crypto: Can the Feds Tame It?

Bots Gone Wild or Calculated Crime? Crypto Trial's Verdict Could Redefine "Fair" The Algorithm vs. t...

CIFR Stock Soars on Amazon Deal: What Happened and Why?

CIFR's $5.5 Billion Amazon Deal: Are We Witnessing the Dawn of Decentralized AI Power? Okay, folks,...