✔️ Final Title: Crypto Market: The Data's Quiet Warning (- Thoughts?)

SUI's Object-Oriented Design: A Real Game Changer or Just Clever Marketing?

Sui is making waves, promising a revolution in Web3 application development. The core argument? Its object-oriented design is somehow inherently superior. They claim it allows for low-latency transactions, stable fees, high throughput, and powerful tools for developers. That's a lot of promises. Let's see if the numbers back it up, or if it's just a well-crafted marketing narrative.

The Promise of Parallel Transaction Execution

The core of the Sui argument hinges on the idea that treating everything as an object allows for parallel transaction execution. Traditional blockchains process transactions sequentially, like a single-lane highway. Sui, supposedly, opens up multiple lanes because it can identify independent transactions and process them simultaneously. The claim is that this bypasses the traditional consensus mechanism, leading to sub-half-second finality. It sounds great in theory, but the devil's in the implementation details. The question is, how often are transactions truly independent? In a complex DeFi application, for example, many transactions will inevitably depend on the outcome of others. If Transaction A depends on the successful execution of Transaction B, you're back to waiting in line.

Features vs. Inherent Advantages

And that's the part of the whitepaper I find genuinely puzzling. They tout zkLogin and sponsored transactions as solutions to common Web3 adoption barriers. zkLogin supposedly simplifies wallet onboarding through familiar web logins (like Google), and sponsored transactions eliminate user fees. But these are features, not inherent advantages of the object-oriented architecture itself. You could implement zkLogin on any blockchain. The argument feels...conflated. They're mixing the benefits of the underlying architecture with the benefits of specific tools built on top of it. Are these genuinely innovative or just re-packaged versions of existing solutions?

Regulatory Winds of Change

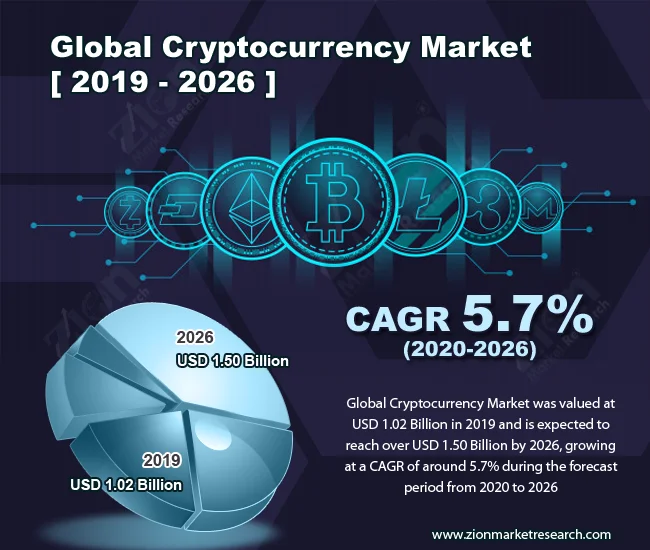

The broader crypto landscape is also shifting, and it's hard to isolate Sui's specific impact. The TRM Labs report highlights that 2025 was a year of regulatory clarity meeting market momentum. Stablecoins took center stage, with over 70% of jurisdictions progressing stablecoin regulation. This regulatory push is creating tailwinds for institutional adoption, with financial institutions announcing new digital asset initiatives in about 80% of jurisdictions. This is a sector-wide trend.

The US, under the Trump administration (as the report notes), is reshaping the global policy tone. The GENIUS Act is a landmark for stablecoin regulation. But again, none of this is specific to Sui. These are macro-level factors influencing the entire crypto market. The question isn't whether the crypto market is growing (it clearly is), but whether Sui is capturing a disproportionate share of that growth due to its object-oriented design. The available data doesn't give us a clear answer. For a broader perspective on the regulatory outlook, see the Global Crypto Policy Review Outlook 2025/26 Report.

The Hype Cycle Continues

Sui's architecture might indeed offer some technical advantages, particularly in specific use cases where transaction independence is high. But let's be honest, the marketing is outpacing the demonstrable results. They're selling a vision of a frictionless, high-throughput Web3 future, and the object-oriented design is the magic ingredient. But, in reality, the benefits are more nuanced and depend heavily on the specific application.

The crypto market is prone to hype cycles. A new technology emerges, promises are made, valuations soar, and then reality sets in. (Remember the ICO boom of 2017?). Sui might be a genuinely innovative platform, but it's also riding that wave. The key for investors is to separate the signal from the noise, to look beyond the marketing and assess the actual performance metrics. Are transaction fees consistently lower? Is throughput significantly higher than competing platforms under real-world conditions? The answers to those questions will determine whether Sui is a true game-changer or just another flash in the pan.

Reality Check

Object-oriented design could be a significant step forward for blockchain technology. Sui's marketing is definitely effective. But right now, the data simply isn't conclusive enough to justify the hype. More data is needed.

Previous Post:Passive Crypto Staking: It's Not Free Money. (- Reddit Riches?)

No newer articles...

Related Articles

Concordium ($CCD) Lists on Kraken: What the Listing Reveals About Its 'Compliance-First' Strategy

The Quiet Bet on Boring: Deconstructing Concordium's Institutional Play Another day, another token l...

NEAR Protocol's Price Prediction: Will it Rally, or is This Another Pump and Dump?

Alright, let's cut the crap. Another day, another crypto project claiming to be the "future," this t...

The Aster DEX Breakthrough: What It Is and Why It’s a Glimpse Into DeFi’s Future

A number gets thrown around in technology that is so large it almost loses its meaning: a trillion....

Concordium's Market Attention: A Soaring CCD and What It Means

Concordium's Compliance Play: Is It Enough to Win? Concordium is making a serious bet on compliance....

Solana's Bull Party is Over: What Happened?

Okay, so Solana crapped the bed yesterday. Broke below some "upward trendline" from April, and now e...

Plasma: What It Is, How It Saves Lives, and What Comes Next

The night sky over Wyoming split open. It wasn’t the familiar, ghostly dance of the aurora that Andr...